I am not trying to confuse clients with additional terminology of financial life planning. I know the public has more financial articles, blogs, internet pages, mailers, seminars, and total noise presented from or by financial planners, brokers, insurance professionals, pretend financial guru’s, and other media noise that probably confuses clients on what financial services should they be looking for and what questions should they be asking?

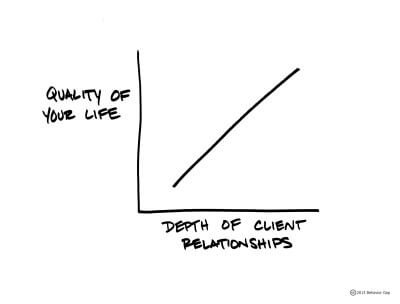

Because of unpredictability of life and the complexity of financial markets and global economy, it is important to work with a financial advisor who will help you to achieve your financial and life goals and aspirations. The financial life planning process will truly understand you before the numbers along with your concerns and dreams. The process also includes understanding your unique set of values, priorities, challenges, and opportunities in order to assist in providing the appropriate financial and personal recommendations and strategies. This leads us to the real definition of Financial Life Planning:

Because of unpredictability of life and the complexity of financial markets and global economy, it is important to work with a financial advisor who will help you to achieve your financial and life goals and aspirations. The financial life planning process will truly understand you before the numbers along with your concerns and dreams. The process also includes understanding your unique set of values, priorities, challenges, and opportunities in order to assist in providing the appropriate financial and personal recommendations and strategies. This leads us to the real definition of Financial Life Planning:

“Financial Life Planning is a holistic process that puts the clients interests first and focuses on increasing a clients sense of financial well-being and life satisfaction. Initially, this process will help a client clarify their values, priorities, circumstances, and aspirations; and then guide a client in defining and designing a unique version of the “rich life.” In addition, Financial Life Planning will increase a clients understanding of the habits and attitudes that will facilitate their financial and life goals to support successful life transitions. Simply put, Financial Life Planning is understanding YOU before the numbers!”

Further articles will analyze differences of financial services offered by financial advisors, the questions clients should consider asking during their interview process along with advisor compensation for the financial services they provide to clients and how to evaluate your cost versus your service return.

Many thanks to Amy Mullen from Money Quotient for her valuable insight into and wonderful research and articles about creating Financial Life Planning and Hugh Massie at Behavioral International DNA for providing insight into a clients learned versus natural behavior and why understanding the client before the numbers is changing the financial services approach and behavioral processes.